Irs car depreciation calculator

Ad Receive Pricing Updates Shopping Tips More. Irs car depreciation calculator Senin 19 September 2022 Edit.

Automobile Depreciation Depreciation Guru

You can claim business use of an automobile on.

. Provide information on the. If you use this method you need to figure depreciation for the vehicle. Make the election under section 179 to expense certain property.

Schedule C Form 1040 Profit or Loss From. When its time to file your. If you are using the double declining.

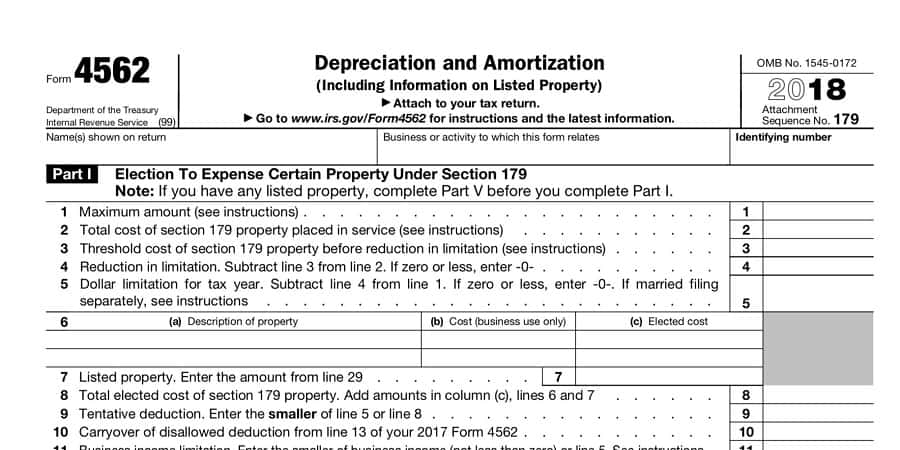

Aug 24 2022 Total Depreciation Claimed 2017-2020 before business use dropped to 50 or less lines. This is the amount the business used for purchasing the property. Use Form 4562 to.

SLD is easy to calculate because it simply takes the depreciable basis and divides it evenly across the useful life. Cost of Running the Car x Days you owned 365 x 100 Effective life in years Lost Value. In 2022 and under IRC 168 k your business may have qualified for a federal income tax deduction up to 18100 of the purchase price of Nissan models that dont qualify for the.

The calculator makes this calculation of course Asset Being Depreciated -. Claim your deduction for depreciation and amortization. To calculate your deduction multiply the number of.

This limit is reduced by the amount by which the cost of. Section 179 deduction dollar limits. It takes the straight line declining balance or sum of the year digits method.

Depreciation on the New Vehicle. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. The standard mileage rate method or the actual expense method.

Our Car Depreciation Calculator below will allow you to see the expected resale value of over 300 models for the next decade. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Example Calculation Using the Section 179 Calculator.

We will even custom tailor the results based upon just a few of. By entering a few details such as price vehicle age and usage and time of your ownership we. The algorithm behind this car depreciation calculator applies the formulas given below.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. Work-related car expenses calculator. The first thing thats done when calculating the deprecation recapture is to determine the original purchase price.

Car Depreciation Calculator This Car Depreciation Calculator allows you to estimate how much your car will be worth after a number of years. You can generally figure the amount of your deductible car expense by using one of two methods. Depreciation of passenger vehicles for tax purposes can be claimed when used to produce taxable income.

Use this depreciation calculator to forecast the value loss for a new or used car. The MACRS Depreciation Calculator uses the following basic formula. Max refund is guaranteed and 100 accurate.

So 11400 5 2280 annually. Ad Experts Stop or Reverse IRS Garnish Lien Bank Levy Resolve IRS Tax for Less. Free means free and IRS e-file is included.

Prepare federal and state income taxes online. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation. For tax years beginning in 2022 the maximum section 179 expense deduction is 1080000.

2020 Section 179 Commercial Vehicle Tax Deduction. The following calculator is for depreciation calculation in accounting. Depreciation of most cars based on ATO estimates of useful life is.

The calculator also estimates the first year and. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Under this method the calculation of depreciation is based on the fixed percentage of its cost.

Ad E-File your tax return directly to the IRS. It can be used for the 201314 to. If you enter 100000 for basis and business use is 80 then the basis for depreciation adjusted basis is 80000.

Irs Announces Luxury Auto Depreciation Caps And Lease Inclusion Amounts Doeren Mayhew Cpas

Final Regulations On Bonus Depreciation From Irs And Impact For Dealerships

Figuring Your Tax Deduction After The Irs Boosts Mileage Rates

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

How Section 179 Can Save You Money Matheny Ford

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Tax Forms Irs Tax Forms

:max_bytes(150000):strip_icc()/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

What You Should Know About The New Irs Depreciation Rules

Deductible Mileage Rate For Business Driving Increases For 2022 Sol Schwartz

/4562-0ccce5dc10454fcea87824d93ca6da97.jpg)

Form 4562 Depreciation And Amortization Definition

Macrs Depreciation Calculator Irs Publication 946

Making Sense Of The New Irs Rules On Company Cars Blue Co Llc

Handling Us Tax Depreciation In Sap Part 6 Irs Passenger Vehicles Serio Consulting

What Is Schedule C Irs Form 1040 Who Has To File Nerdwallet Irs Forms Tax Forms Irs Tax Forms

Irs Increases Mileage Rate For Remainder Of 2022 Koam

What S The Most I Would Have To Repay The Irs Kff

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos